All Categories

Featured

Table of Contents

Section 691(c)( 1) supplies that an individual who includes an amount of IRD in gross earnings under 691(a) is permitted as a reduction, for the exact same taxed year, a section of the inheritance tax paid because the inclusion of that IRD in the decedent's gross estate. Typically, the quantity of the reduction is determined using estate tax values, and is the amount that births the very same proportion to the estate tax attributable to the internet value of all IRD products included in the decedent's gross estate as the value of the IRD consisted of because person's gross revenue for that taxable year births to the worth of all IRD things consisted of in the decedent's gross estate.

Rev. Rul., 1979-2 C.B. 292, attends to a scenario in which the owner-annuitant purchases a deferred variable annuity contract that gives that if the owner passes away prior to the annuity beginning date, the named beneficiary might elect to get the present accumulated value of the agreement either in the kind of an annuity or a lump-sum payment.

Rul. If the recipient chooses a lump-sum settlement, the unwanted of the amount got over the quantity of consideration paid by the decedent is includable in the recipient's gross revenue.

Rul (Annuity contracts). 79-335 concludes that the annuity exception in 1014(b)( 9 )(A) relates to the contract described in that ruling, it does not especially address whether amounts obtained by a beneficiary under a postponed annuity contract in unwanted of the owner-annuitant's financial investment in the agreement would go through 691 and 1014(c). Had the owner-annuitant surrendered the contract and obtained the quantities in excess of the owner-annuitant's financial investment in the contract, those amounts would certainly have been revenue to the owner-annuitant under 72(e).

Is there tax on inherited Multi-year Guaranteed Annuities

In the existing instance, had A gave up the agreement and obtained the amounts at issue, those amounts would certainly have been earnings to A under 72(e) to the degree they went beyond A's financial investment in the contract. Accordingly, amounts that B receives that go beyond A's investment in the agreement are IRD under 691(a).

, those quantities are includible in B's gross revenue and B does not get a basis change in the contract. B will be entitled to a deduction under 691(c) if estate tax was due by factor of A's death.

The holding of Rev. Rul. 70-143 (which was withdrawed by Rev. Rul. 79-335) will certainly remain to make an application for postponed annuity agreements purchased prior to October 21, 1979, including any contributions related to those agreements pursuant to a binding commitment got in right into prior to that date - Annuity contracts. COMPOSING details The principal writer of this profits judgment is Bradford R

Q. Just how are annuities exhausted as an inheritance? Is there a distinction if I acquire it directly or if it mosts likely to a trust for which I'm the beneficiary?-- Preparation aheadA. This is a terrific question, however it's the kind you must require to an estate preparation attorney that understands the information of your scenario.

What is the partnership in between the dead proprietor of the annuity and you, the recipient? What kind of annuity is this? Are you asking around revenue, estate or inheritance taxes? Then we have your curveball concern concerning whether the result is any various if the inheritance is via a depend on or outright.

We'll think the annuity is a non-qualified annuity, which means it's not part of an IRA or other professional retirement plan. Botwinick said this annuity would certainly be included to the taxable estate for New Jersey and government estate tax obligation purposes at its date of fatality value.

Deferred Annuities inheritance tax rules

resident spouse goes beyond $2 million. This is referred to as the exemption.Any amount passing to a united state resident partner will certainly be entirely excluded from New Jersey estate tax obligations, and if the owner of the annuity lives to the end of 2017, then there will be no New Jacket estate tax on any quantity since the inheritance tax is set up for repeal beginning on Jan. There are government estate tax obligations.

The existing exception is $5.49 million, and Botwinick claimed this tax is possibly not disappearing in 2018 unless there is some significant tax obligation reform in an actual rush. Fresh Jersey, government inheritance tax regulation gives a complete exemption to quantities passing to surviving U.S. Next, New Jersey's inheritance tax.Though the New Jersey inheritance tax is arranged

to be reversed in 2018, there is noabolition set up for the New Jacket estate tax, Botwinick said. There is no federal estate tax. The state tax obligation is on transfers to everyone other than a certain course of individuals, he stated. These consist of spouses, youngsters, grandchildren, parent and step-children." The New Jacket inheritance tax obligation applies to annuities simply as it puts on other properties,"he claimed."Though life insurance policy payable to a certain beneficiary is exempt from New Jacket's inheritance tax, the exception does not apply to annuities. "Now, revenue taxes.Again, we're presuming this annuity is a non-qualified annuity." Essentially, the earnings are taxed as they are paid out. A portion of the payout will be treated as a nontaxable return of financial investment, and the profits will be strained as normal income."Unlike inheriting other possessions, Botwinick claimed, there is no stepped-up basis for acquired annuities. If estate tax obligations are paid as a result of the inclusion of the annuity in the taxed estate, the beneficiary might be entitled to a deduction for inherited revenue in respect of a decedent, he claimed. Annuity repayments consist of a return of principalthe money the annuitant pays right into the contractand rate of interestearned inside the agreement. The interest part is taxed as regular income, while the major amount is not tired. For annuities paying over a more extensive period or life span, the major section is smaller, resulting in less taxes on the month-to-month settlements. For a married pair, the annuity agreement may be structured as joint and survivor so that, if one spouse dies , the survivor will remain to get guaranteed settlements and enjoy the very same tax obligation deferment. If a beneficiary is called, such as the pair's youngsters, they become the recipient of an inherited annuity. Recipients have several alternatives to take into consideration when selecting how to receive money from an acquired annuity.

Table of Contents

Latest Posts

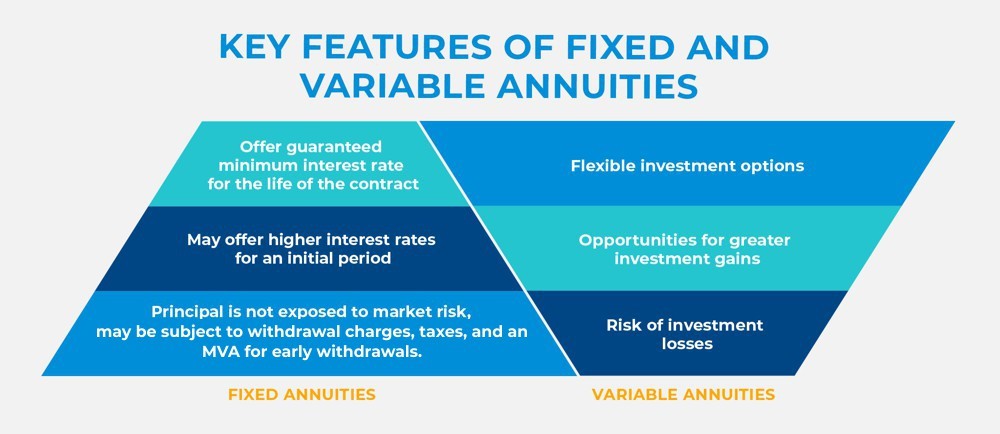

Breaking Down Fixed Index Annuity Vs Variable Annuities Key Insights on Your Financial Future Defining Fixed Annuity Or Variable Annuity Advantages and Disadvantages of Different Retirement Plans Why

Highlighting Variable Vs Fixed Annuity Key Insights on Your Financial Future What Is What Is A Variable Annuity Vs A Fixed Annuity? Features of Variable Vs Fixed Annuities Why Fixed Indexed Annuity Vs

Understanding Financial Strategies Everything You Need to Know About Fixed Vs Variable Annuity Pros And Cons Breaking Down the Basics of What Is Variable Annuity Vs Fixed Annuity Pros and Cons of Vari

More

Latest Posts